Autoregressive conditional duration

In financial econometrics, an autoregressive conditional duration (ACD, Engle and Russell (1998)) model considers irregularly spaced and autocorrelated intertrade durations. ACD is analogous to GARCH. Indeed, in a continuous double auction (a common trading mechanism in many financial markets) waiting times between two consecutive trades vary at random.

Definition

Specifically, let  denote the duration (the waiting time between consecutive trades) and assume that

denote the duration (the waiting time between consecutive trades) and assume that  , where

, where  , positive and with

, positive and with  and where the series

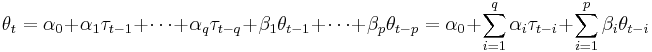

and where the series  is given by

is given by

and where  ,

,  ,

,  ,

,  .

.

References

- Robert F. Engle and J.R. Russell. "Autoregressive Conditional Duration: A New Model for Irregularly Spaced Transaction Data", Econometrica, 66:1127-1162, 1998.

- N. Hautsch. "Modelling Irregularly Spaced Financial Data", Springer, 2004.